green card exit tax rate

If the profit on your assets is over 725000 you only have to pay exit tax on the amount that is over the threshold. In summary when giving back.

Never Give Up Or You Ll Be Surprised

Green card exit tax rate.

. 200000 71100 128900. Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation. The IRS then takes this final gain and taxes it at the appropriate rates.

It will be as. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. For example if you made a profit of 750000 on your.

The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market value on the day before. The estate tax was repealed for 2010 but will reappear in 2011 with a top rate of 60 percent and an applicable exclusion amount of only 1000000 unless Congress acts. Permanent residents and green card holders are also required to pay taxes.

Some taxpayers have to pay an Additional Medicare Tax of 09 if they earn more than 250000 for those who are married and filing jointly or more than 200000 for single. Exit tax when gives up a green card. Government revokes their green card visa.

Eligible deferred compensation items including 401 ks will only be taxed upon distribution and generally subject to 30 withholding tax. If you are covered then you will trigger the green card exit tax when you renounce your status. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US.

Currently net capital gains can be taxed as high as. If you had enough of the American life and decided to move to a Tax-haven in the Middle-East or Europe where your foreign earned dollars would go the extra mile you can surrender your. Failure to file a tax return as a green card holder is punishable by fees of 5 of the total.

Avvo has 97 of all lawyers in the US. Find the best ones near you. In some cases you can be taxed up to 30 of your total net worth.

For calendar year 2022 an individual is a covered expatriate if the individuals average annual net income tax for the five taxable years ending before the expatriation date is. This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax Your average net income tax liability from the past five years is over. 1800000 639900 1160100.

.png)

How The Us Exit Tax Is Calculated For Covered Expatriates

Frequently Asked Questions About The Us Tax Consequences Of Holding A Us Green Card And Surrendering One

Us Exit Taxes The Price Of Renouncing Your Citizenship

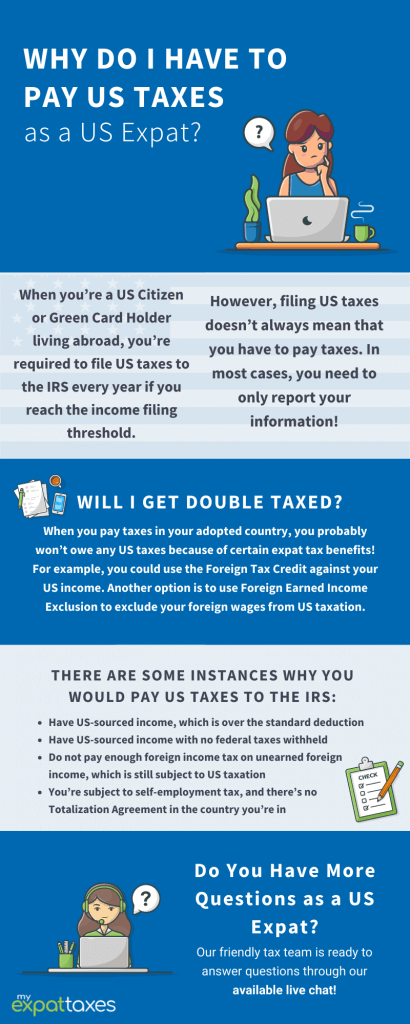

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Poland Taxation Of International Executives Kpmg Global

Exit Tax Us After Renouncing Citizenship Americans Overseas

:max_bytes(150000):strip_icc()/WritingDownIdeas-60e55a52483a4b8d80cec9488854dc82.jpg)

Tips For Green Card Holders Filing U S Tax Returns

Exit Tax In The Us Everything You Need To Know If You Re Moving

Exit Tax Us After Renouncing Citizenship Americans Overseas

The Benefits Of A Green Card Boundless

Exit Tax Us After Renouncing Citizenship Americans Overseas

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

The Taxes That Raise Your International Airfare Valuepenguin

%20(1).png)

How The Us Exit Tax Is Calculated For Covered Expatriates

Tas Tax Tip Small Business Tax Highlights Tas

Income Taxes And Immigration Consequences Citizenpath